The Cash App $12.5M class action settlement could deliver payments of up to $147 to eligible Washington state residents after the company agreed to resolve allegations that its referral program violated state consumer protection laws. The agreement, announced in October 2025, comes amid growing scrutiny of how fintech companies use text messaging to recruit new customers.

Cash App $12.5M Class Action Settlement 2025

| Key Fact | Detail / Statistic |

|---|---|

| Total Settlement Fund | $12.5 million |

| Estimated Individual Payout | Up to $147 |

| Eligibility Period | Nov. 14, 2019 – Aug. 7, 2025 |

| Claim Deadline | Oct. 27, 2025 |

| Court Final Approval Hearing | Dec. 2, 2025 |

How Cash App’s Referral Program Sparked a Lawsuit

Cash App, launched in 2013 by Block Inc. (formerly Square), grew rapidly by allowing users to send and receive money instantly via smartphones. A major driver of its expansion was its “Invite Friends” program, which rewarded existing users with cash bonuses for every new person they signed up.

The program relied heavily on text message invitations. Users were prompted to share their contacts, and in some cases, messages were sent automatically to recipients who had never opted in. These messages became the center of the lawsuit.

According to legal filings, thousands of Washington residents received unsolicited texts promoting Cash App between November 14, 2019, and August 7, 2025. Plaintiffs argued that the messages violated the Washington Commercial Electronic Mail Act and the Washington Consumer Protection Act, both of which restrict unsolicited marketing communications.

The Settlement Terms and What’s at Stake

Financial Breakdown

Under the agreement, Cash App will pay $12.5 million to a settlement fund. The amount each eligible claimant receives will depend on the number of valid claims filed. Estimates currently range from $88 to $147 per person. Administrative costs, legal fees, and incentive awards to lead plaintiffs will be deducted from the total.

No Admission of Wrongdoing

Cash App has denied all allegations, stating that its referral messages complied with existing laws. The company agreed to settle the case “to avoid the expense and uncertainty of further litigation.”

“Class action settlements like this one are often about efficiency and risk management rather than admitting liability,” said Dr. Anya Sharma, senior legal fellow at the Brookings Institution. “But they can still have a significant regulatory and financial impact.”

Regulatory Context: How Laws Protect Consumers

State and Federal Legal Framework

This case is rooted in Washington’s anti-spam statutes, which are among the strongest in the United States. These laws allow consumers to sue companies that send unsolicited commercial messages.

In parallel, federal regulation under the Telephone Consumer Protection Act (TCPA) restricts certain types of automated calls and texts nationwide. Washington’s additional protections make it easier to pursue civil action at the state level.

“Washington has positioned itself as a leader in regulating unsolicited communications,” explained Professor Laura Mitchell, a consumer law expert at the University of Washington School of Law. “This creates a powerful deterrent effect for companies that rely on aggressive marketing.”

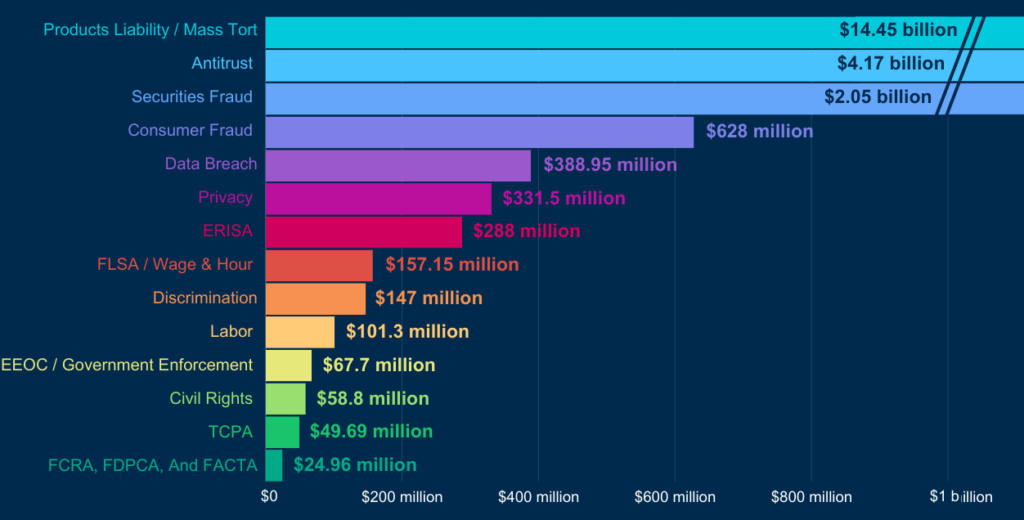

Precedents in Digital Marketing Lawsuits

This isn’t the first major company to face such claims. In recent years:

- Uber settled a $20 million lawsuit over similar referral texts in 2022.

- DoorDash faced legal action in California for its promotional SMS campaigns in 2023.

- Several U.S. retailers have also settled TCPA cases involving unsolicited marketing messages.

Who Qualifies for the Cash App Settlement

To receive payment, individuals must meet several eligibility criteria:

- They must have resided in Washington state when the message was received.

- They must have received a referral text from Cash App between November 14, 2019, and August 7, 2025.

- They must not have given prior consent to receive the text.

- Their phone number must appear in Cash App’s records.

- They must submit a valid claim by October 27, 2025.

How to File a Claim for Cash App $12.5M Class Action Settlement 2025

How to Submit

Eligible individuals can file a claim online through the official settlement website, expected to go live following preliminary court approval. Paper claim forms will also be accepted. Claimants must provide the phone number that received the text message and verify that they did not consent to the communication.

Payment Methods

If the settlement receives final court approval, payments will be distributed in early 2026. Consumers may choose to receive funds by direct deposit, check, or digital payment methods, reflecting the nature of the service itself.

Handling Disputes

If a claim is denied, consumers will have the right to appeal through the settlement administrator. Common reasons for denial may include mismatched phone numbers or failure to meet residency requirements.

Legal Timeline and Court Procedure

- Preliminary Approval (October 2025) – Settlement terms are approved for notice distribution.

- Claims Period (Oct. 2025 – Oct. 27, 2025) – Consumers file claims.

- Objection/Opt-Out Deadline (Nov. 2025) – Class members may object or opt out.

- Final Approval Hearing (Dec. 2, 2025) – Court decides whether to approve the settlement.

- Distribution (Early 2026) – Payments are issued to eligible claimants.

If the court does not approve the settlement, the lawsuit may return to litigation.

“The approval hearing is crucial,” noted Evelyn Price, a class action attorney based in Seattle. “If the court determines the settlement is fair and adequate, it will move forward. If not, the parties could renegotiate or go to trial.”

Economic and Industry Implications

The Cash App case reflects a broader reckoning for fintech companies that rely on viral marketing to grow. Digital referral programs can reach millions quickly, but they also risk violating privacy and consumer protection laws.

Fintech Marketing Under the Microscope

Analysts expect companies across the industry to tighten their compliance programs and adjust referral strategies. Many are adopting double opt-in systems, where users confirm they consent before receiving promotional messages.

“Companies are realizing that the cost of noncompliance can far outweigh the benefits of aggressive growth tactics,” said James Holloway, senior fintech analyst at CB Insights.

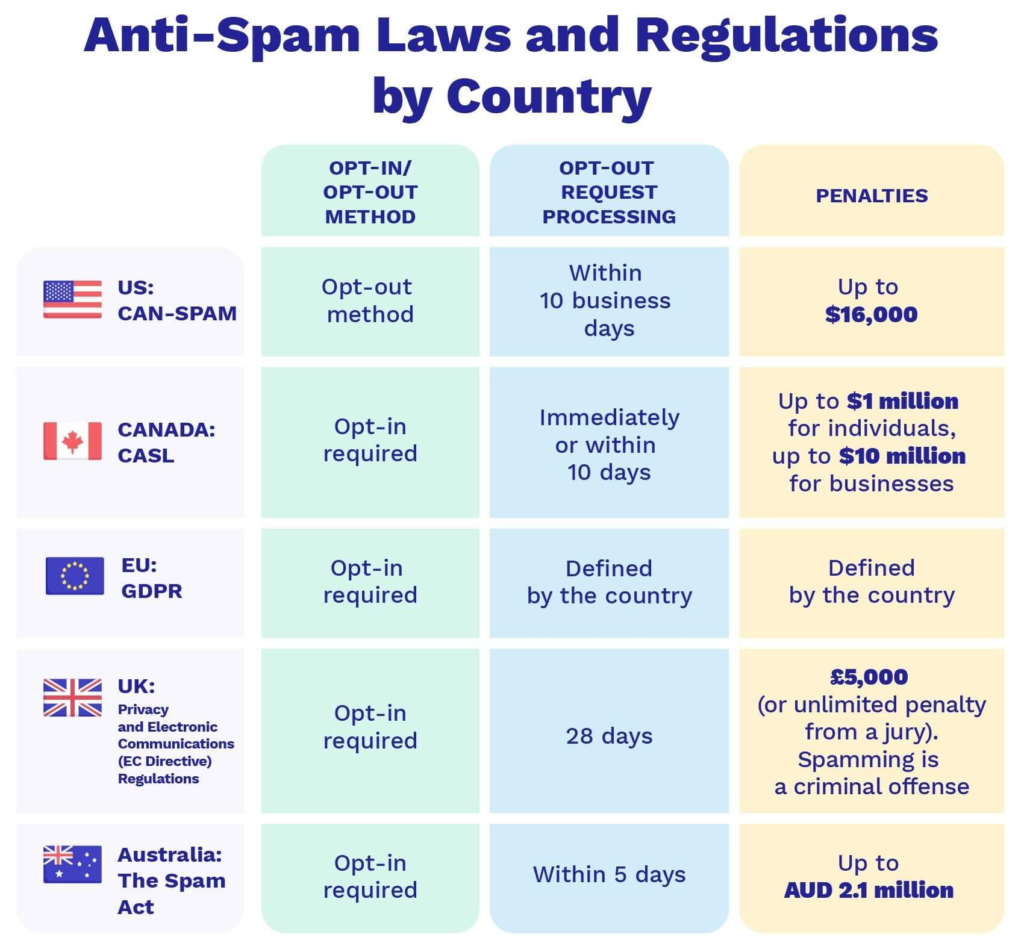

Global Perspective: How Other Jurisdictions Handle Spam

Unlike the U.S., where enforcement varies by state, Europe’s General Data Protection Regulation (GDPR) requires explicit opt-in for all marketing communications. Canada’s Anti-Spam Legislation (CASL) similarly imposes steep penalties for unsolicited texts or emails.

These stricter regimes are often cited as models for future U.S. legislation. If states continue to take action individually, more companies may face patchwork compliance challenges.

Consumer Reactions and Broader Sentiment

While class action payouts are typically modest, claimants view them as symbolic victories. Several Washington residents have expressed relief that companies are being held accountable for invasive marketing.

“I didn’t sign up to get spammed with texts,” said Maria P., a Seattle resident who received an invitation message in 2022. “This isn’t just about $147 — it’s about companies respecting our consent.”

Industry observers believe this case could lead to more consumer awareness about digital privacy rights, particularly around text messaging.

$425M Capital One Settlement – Final Chance to Claim Your Money Before the Deadline!

Forward Outlook: What Happens Next

The final approval hearing is scheduled for December 2, 2025. If approved, Cash App will distribute payments shortly after the claims period closes. Observers expect other fintech firms to reassess their referral and marketing programs in response to this settlement.

Legal experts say state-level actions will likely continue shaping national marketing practices, even without new federal legislation.

FAQ About Cash App $12.5M Class Action Settlement 2025

How do I check if I’m eligible?

Eligibility is verified through Cash App’s internal text message records. There is no public list.

What if I no longer live in Washington?

Eligibility depends on where you lived when the message was received, not your current address.

How can I receive the payment?

Eligible claimants can choose direct deposit, check, or digital payment.

What if the court doesn’t approve the settlement?

The case may proceed to further litigation or renegotiation.

Will this affect other states?

No. This case applies only to Washington state residents, but it may influence similar lawsuits elsewhere.