Thousands of California residents may be eligible for payments of up to $5,000 each as part of a $19.5 million Wells Fargo settlement, following allegations that the bank and its contractor unlawfully recorded customer calls without consent between 2014 and 2023. The settlement, pending final court approval, marks one of the most significant privacy-related class actions in recent years and highlights growing scrutiny of corporate surveillance practices.

Wells Fargo Settlement

| Key Fact | Detail |

|---|---|

| Total Settlement Fund | $19.5 million |

| Eligible Period | October 22, 2014 – November 17, 2023 |

| Estimated Payout per Call | $86 average; up to $5,000 maximum |

| Claim Deadline | April 11, 2025 |

| Final Approval Hearing | May 20, 2025 |

| Payment Timeline | Expected 52 days after court approval |

Why the Wells Fargo Settlement Was Filed

The Wells Fargo settlement stems from a class action lawsuit alleging violations of the California Invasion of Privacy Act (CIPA). Plaintiffs claimed that Wells Fargo, working with The Credit Wholesale Company, Inc., recorded phone calls made to California residents and businesses without informing them, as required by state law.

The calls reportedly took place over a nine-year period. Plaintiffs argued that the lack of consent constituted a serious invasion of privacy. Wells Fargo has denied wrongdoing but agreed to the settlement to avoid the uncertainty of a trial.

“This settlement reflects the seriousness of privacy violations under California law,” said Jessica Rosen, a legal analyst at the Electronic Privacy Information Center. “CIPA is one of the strongest consumer privacy laws in the country, and it allows significant damages per violation.”

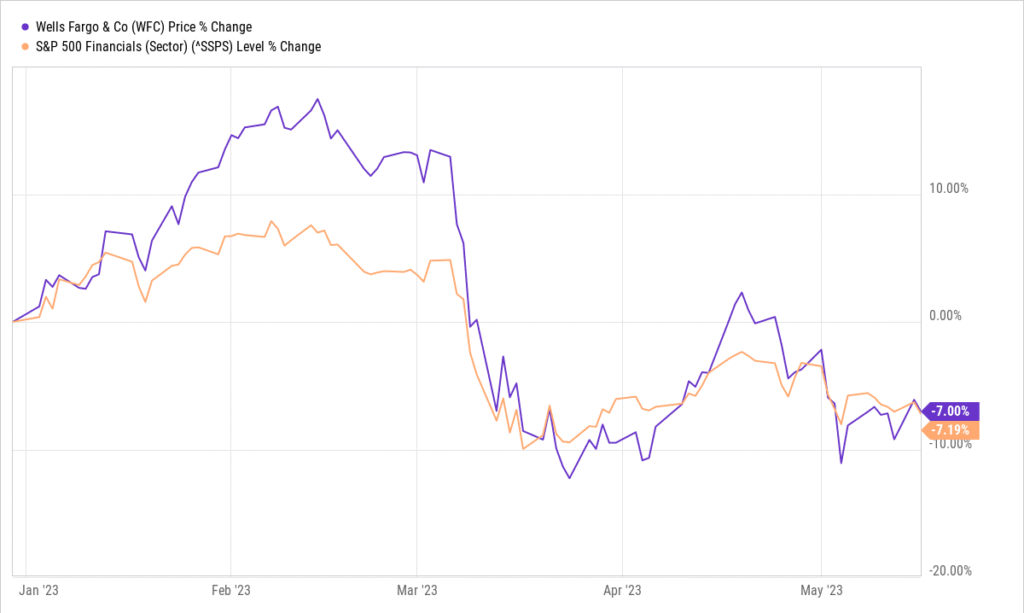

Wells Fargo’s History of Regulatory Challenges

This case is not the first time Wells Fargo & Company has faced legal scrutiny. In the past decade, the bank has paid billions in fines for various violations.

- In 2016, federal regulators fined Wells Fargo $185 million for creating millions of unauthorized customer accounts.

- In 2022, the Consumer Financial Protection Bureau (CFPB) imposed a $3.7 billion penalty over consumer loan and account management practices.

- Additional settlements have involved mortgage lending, auto insurance, and overdraft fees.

Legal experts say these repeated violations have eroded public trust in one of the country’s largest banks. “Wells Fargo has been a repeat player in consumer protection cases,” noted David Chen, a financial law professor at Stanford University. “This new settlement underscores how privacy concerns are joining financial misconduct as a major source of corporate liability.”

Who Qualifies for the Wells Fargo Settlement

To qualify, individuals or businesses must meet the following conditions:

- Reside or operate in California.

- Have received a phone call from The Credit Wholesale Company on behalf of Wells Fargo between October 22, 2014, and November 17, 2023.

- The call must have been recorded without their consent.

Claimants do not need to prove they were bank customers. The settlement relies on call records to confirm eligibility.

“This isn’t just about bank customers,” explained Lisa Montoya, senior counsel at a California consumer rights group. “It’s about anyone whose privacy may have been violated.”

Privacy and Call Recording in the U.S.

The Wells Fargo settlement also sheds light on a broader debate over privacy and corporate surveillance in the United States.

Unlike federal law, which requires one-party consent for call recording in many situations, California mandates two-party consent, meaning everyone on a call must agree to recording. Violations can lead to statutory damages of $5,000 per call, making California one of the strictest jurisdictions for privacy enforcement.

Similar cases have emerged against other companies, including telecommunications firms and retailers. Experts say these lawsuits signal increasing consumer awareness of privacy rights.

“Technology has made it easy to record calls, but companies must follow state laws,” said Mark Boudreaux, a consumer protection attorney. “California’s laws are especially tough, and we’ll likely see more litigation of this kind.”

How Much Participants Could Receive

The settlement sets aside $19.5 million to compensate eligible claimants. According to the settlement administrator, payments are estimated at around $86 per call, but could reach a maximum of $5,000 per call depending on the number of valid claims submitted.

Class members can submit claims through an official settlement website. Payment distribution is expected approximately 52 days after final approval, tentatively placing disbursement in mid-to-late 2025.

“Settlement distributions in privacy cases vary widely,” explained Dr. Anya Sharma, professor of law at the University of California, Berkeley. “High per-call payouts are possible only if relatively few claims are filed.”

Step-by-Step Guide to Filing a Claim

For eligible Californians, filing a claim is free and straightforward. Here’s how the process works:

- Visit the official settlement website (link provided in court documents).

- Enter your phone number to verify if it is associated with the alleged recorded calls.

- Provide basic contact details, such as name, mailing address, and email.

- Submit your claim before April 11, 2025.

- Check for confirmation by email. No additional payment or legal representation is required.

- Wait for settlement approval. If approved, payments will be issued approximately 52 days after the May 20 court hearing.

Officials caution consumers against scams. The settlement administrator will not ask for sensitive financial information or upfront payments.

Timeline and What Comes Next

The claim submission deadline is April 11, 2025, with a final approval hearing scheduled for May 20, 2025 in the U.S. District Court for the Central District of California. If approved, payments will follow in summer 2025.

Consumers who wish to participate must file a claim before the deadline. They may also opt out of the settlement or object to its terms.

Consumer Reactions and Potential Impact

Early reaction to the settlement has been mixed. Some consumer advocates welcome it as an important win for privacy rights. Others worry that actual payouts will be lower than the maximum headline figure.

“It’s encouraging to see companies held accountable,” said Maria Gomez, a small business owner from Los Angeles who received multiple calls during the relevant period. “But I hope people aren’t misled into expecting thousands of dollars when the average payout might be much less.”

Industry groups say the case could prompt companies to revise their compliance protocols. “Firms are reevaluating their call recording policies in California,” said John Peters, a compliance consultant in San Francisco. “The costs of noncompliance are now clearly visible.”

Regulatory and Industry Implications

The Wells Fargo settlement arrives amid a wave of privacy enforcement at both state and federal levels. The California Consumer Privacy Act (CCPA) and California Privacy Rights Act (CPRA) have expanded residents’ control over their personal data.

Legal observers believe this case could push companies to adopt more transparent consent practices nationwide, not just in California.

“We are witnessing a fundamental shift in how privacy law is enforced,” said Lauren Mitchell, senior counsel at the Consumer Privacy Law Center. “Wells Fargo’s settlement will likely be studied as a case example in future compliance training.”

Similar Cases in the U.S.

The Wells Fargo case is part of a broader trend of class actions targeting illegal call recording. Other notable settlements include:

- T-Mobile (2021): Paid $15 million to settle claims involving call recording without consent.

- ADT Security (2022): Agreed to a $25 million settlement after recording customer support calls.

- National Retailers (2020–2023): Several chains faced suits over in-store customer service recordings.

Such cases demonstrate growing legal risks for corporations collecting consumer data without proper disclosure.

Looking Ahead

While the settlement awaits court approval, consumer advocates say it reflects growing accountability for privacy violations in the financial sector. Wells Fargo has stated it “continues to deny all allegations” but agreed to the settlement “to avoid protracted litigation.”

Payments are expected to be distributed by mid- to late 2025. Eligible Californians are encouraged to file claims before the April deadline to secure potential compensation.

Verizon Class Action Settlement 2025 – Claim Deadline and How to Get Your Payout

FAQ About $5,000 Wells Fargo Settlement

Q: Who is eligible for the Wells Fargo settlement?

A: Individuals or businesses in California who received recorded calls from The Credit Wholesale Company on behalf of Wells Fargo between October 2014 and November 2023.

Q: How much can claimants receive?

A: An estimated average of $86 per call, with a maximum possible payment of $5,000 per call depending on the number of claims.

Q: When will payments be issued?

A: Approximately 52 days after the May 2025 court approval.

Q: Do I need to be a Wells Fargo customer to qualify?

A: No, eligibility depends on whether your call was recorded without consent, not on customer status.

Q: Can non-Californians participate?

A: No. This case applies only to California residents or businesses due to state-specific privacy laws.

Q: What happens if I miss the deadline?

A: Individuals who fail to submit a claim by April 11, 2025, will not receive any payment from the settlement.

Q: Can I file my own lawsuit?

A: Yes. Those who opt out of the settlement may pursue individual claims, but they forfeit participation in this class action.