The $1000 stimulus payment widely circulating on social media and several unofficial websites will not be issued by the U.S. federal government on October 29, according to the Internal Revenue Service (IRS) and the U.S. Department of the Treasury. Officials confirmed that no new federal relief program has been authorized.

This clarification comes amid a surge in online search traffic and viral posts promising direct deposits of “stimulus checks” this week. The IRS reiterated that all legitimate stimulus programs are publicly announced through irs.gov and treasury.gov.

$1000 Stimulus Coming Tomorrow

| Key Fact | Detail / Statistic |

|---|---|

| Rumored payment | “$1000 stimulus” arriving Oct. 29 |

| Federal confirmation | No federal stimulus is authorized |

| Real payments in October | Alaska PFD, some state rebates, delayed tax refunds |

| Top federal advice | Beware of phishing and fake links |

No Federal Relief Program Scheduled

Officials from the Treasury Department stated that no legislation authorizing a $1000 stimulus payment exists and no new disbursements will be made this week. Federal stimulus programs require congressional approval and presidential signature — a process that cannot occur in secret.

“There is no such program scheduled or authorized for October 29,” said Carla Jennings, spokesperson for the Treasury. “Any claims suggesting otherwise are false and potentially part of phishing schemes.”

The IRS also issued a consumer alert reminding citizens that the agency never initiates contact by email, text message, or social media for stimulus payments.

Historical Context: How Stimulus Checks Worked in the Past

During the COVID-19 pandemic, the United States issued three rounds of Economic Impact Payments between 2020 and 2021. These payments — $1,200, $600, and $1,400 per eligible person — were the result of major legislation passed by Congress:

- CARES Act (March 2020)

- Consolidated Appropriations Act (December 2020)

- American Rescue Plan Act (March 2021)

Distribution of those funds took weeks to months, and they were announced well in advance with clearly published eligibility criteria.

“This kind of program takes an act of Congress,” explained Dr. Laura Henders, senior economist at the Brookings Institution. “It’s not something that just appears overnight.”

Where the Current Rumor Started

The rumor appears to have originated from misleading websites and short-form videos, many of which reuse old pandemic headlines. Others reference state-level programs, such as Alaska’s annual dividend, and mislabel them as federal stimulus.

Fact-checking organizations, including Reuters, Snopes, and AP Fact Check, have labeled these claims false. Several of the videos link to sites collecting personal information — a common phishing tactic.

State-Level Payments: Not a Federal Program

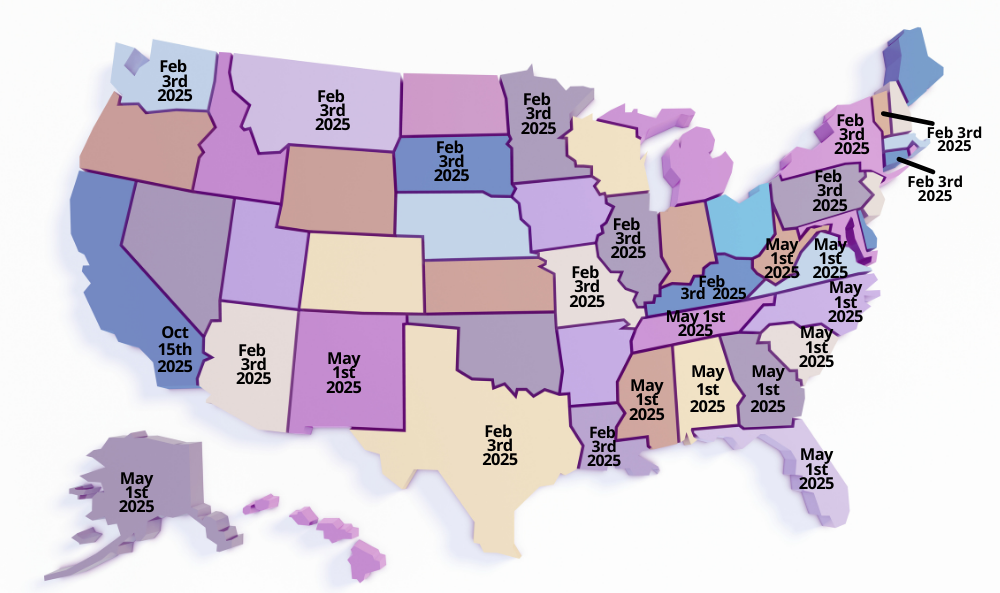

While no national stimulus is scheduled, a handful of states are issuing their own rebate or dividend payments this fall.

- Alaska: The Alaska Permanent Fund Dividend of $1,312 is being distributed in late October.

- Maine: Energy assistance rebates are targeted to low-income households.

- New Mexico: Eligible taxpayers may receive up to $500 in refunds.

- California: The last remaining Middle-Class Tax Refund payments continue for delayed filings.

“These state programs are entirely separate from federal stimulus efforts,” said Dr. Anya Sharma, senior fellow at Brookings. “Unfortunately, scammers exploit this confusion.”

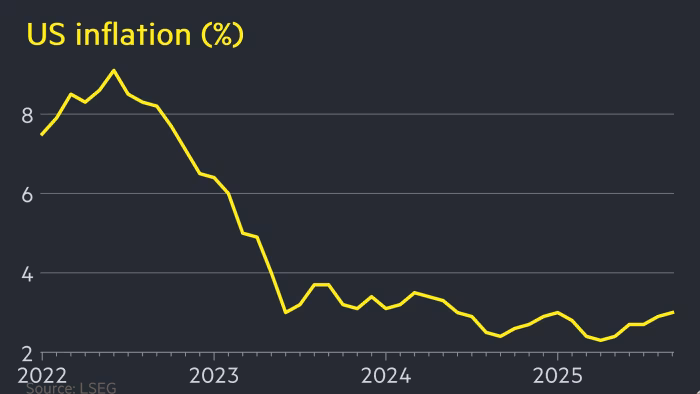

Economic Conditions in 2025: Why No New Stimulus Is Planned

According to the Federal Reserve, inflation has eased to 2.8% as of September 2025 — significantly lower than the pandemic peak of 9.1% in mid-2022. Unemployment remains steady at 4.2%, and GDP growth forecasts are modest but stable.

“Stimulus payments are typically reserved for severe economic shocks,” said Edward Ramos, economist at the University of Michigan. “Right now, there’s no policy justification for emergency cash transfers.”

The Congressional Budget Office (CBO) reported in August that additional stimulus could raise inflationary pressures and increase federal deficits. Lawmakers from both parties have shown little appetite for broad relief checks in the current fiscal environment.

How a Real Federal Stimulus Gets Approved

For a stimulus check to become reality, the process involves several steps:

- Legislative Proposal — A bill must be introduced in either chamber of Congress.

- Congressional Approval — It must pass both the House and Senate.

- Presidential Signature — The President signs the bill into law.

- IRS Program Setup — The IRS prepares systems and eligibility verification.

- Public Announcement — Official communication begins weeks before disbursement.

The last stimulus program in 2021 took roughly six weeks from bill signing to initial payment delivery.

“People should remember how visible and well-covered the last stimulus was,” said Jennifer Lin, legislative analyst at the Center for American Progress. “A secret or surprise stimulus check is not legally or practically possible.”

Political Landscape: No Stimulus on the Table

While some lawmakers have proposed targeted relief for housing or energy costs, no bill calling for broad stimulus checks has advanced this year. Analysts say this reflects both economic conditions and the political climate ahead of the 2026 midterm elections.

“Congress is focused on deficit reduction and long-term spending bills,” said Mark Ellison, senior fellow at the Cato Institute. “Broad stimulus checks are not part of the conversation right now.”

Cybersecurity and Scam Prevention

The Federal Trade Commission (FTC) and Federal Bureau of Investigation (FBI) have both issued alerts regarding stimulus-related scams. Fraudsters often:

- Send fake texts or emails mimicking the IRS.

- Use websites designed to steal personal information.

- Impersonate officials to gain trust.

“If someone says they can ‘guarantee’ your payment, it’s a scam,” warned FBI Special Agent Tara Nguyen. “The only place to check your eligibility is irs.gov.”

Key Red Flags:

- Requests for bank or Social Security numbers.

- Claims you need to “verify” to receive payment.

- Fake countdown timers or urgency language.

How to Check Legitimate Eligibility Criteria for $1000 Stimulus Coming Tomorrow

If the federal government ever issues another stimulus, Americans will be able to:

- Use the official IRS “Get My Payment” tool.

- Check their IRS Online Account for notices.

- View announcements in mainstream media (AP, Reuters, Treasury briefings).

For state-level rebates, individuals should check their official state tax websites, not third-party blogs or social posts.

Expert Outlook: What Could Trigger a Real Future Stimulus?

Economists say a new stimulus program could emerge only under significant economic stress, such as:

- A sharp increase in unemployment

- A severe natural disaster or national emergency

- A major financial crisis

“The threshold is high,” said Dr. Laura Henders. “These programs are expensive and politically difficult. They’re meant as extraordinary measures.”

$425M Capital One Settlement – Final Chance to Claim Your Money Before the Deadline!

FAQ About $1000 Stimulus Coming Tomorrow

Q: Will Americans receive a $1,000 stimulus check on October 29?

A: No. No federal stimulus is scheduled or authorized.

Q: Why are some people still receiving payments this month?

A: Several states have ongoing rebate programs, unrelated to federal stimulus.

Q: Can I still get pandemic stimulus payments I missed?

A: Some individuals may still claim recovery rebate credits on their 2021 or 2022 tax returns.

Q: How can I report a suspected scam?

A: Forward suspicious messages to phishing@irs.gov and file a report at reportfraud.ftc.gov.